Key Takeaways

University endowments that invest more in hedge funds as a part of their long-term strategy have grown faster than endowments that allocate less to hedge funds.

An average university with a $5 billion endowment and a 10% allocation to hedge funds earns nearly $240 million more over five years than an endowment with no allocation to hedge funds.

Introduction

University endowments play a crucial role in providing access to higher education for students in need. Many university endowments invest in alternatives—hedge funds, credit funds, and hybrid funds—to achieve consistent and balanced returns over time. In particular, colleges and universities across the U.S. collectively invest more than $130 billion in hedge funds to support students.

Belying their once-sleepy reputation, university endowment funds are among the most innovative institutional investors, enjoying commensurate success. It has long been recognized that alternative assets, and hedge funds in particular, are an important reason why endowments have done so well. The innovative “endowment model” of investing is often credited to the late David Swensen, manager of Yale University’s endowment, who increased the gains that a long-term investor like Yale could achieve by holding a broad array of unconventional assets. Investments in alternatives are the backbone of the “endowment model” of investing.3

Alternative assets are an important reason why endowments have done so well.

Increased Investment in Hedge Funds Are Associated with Higher Returns

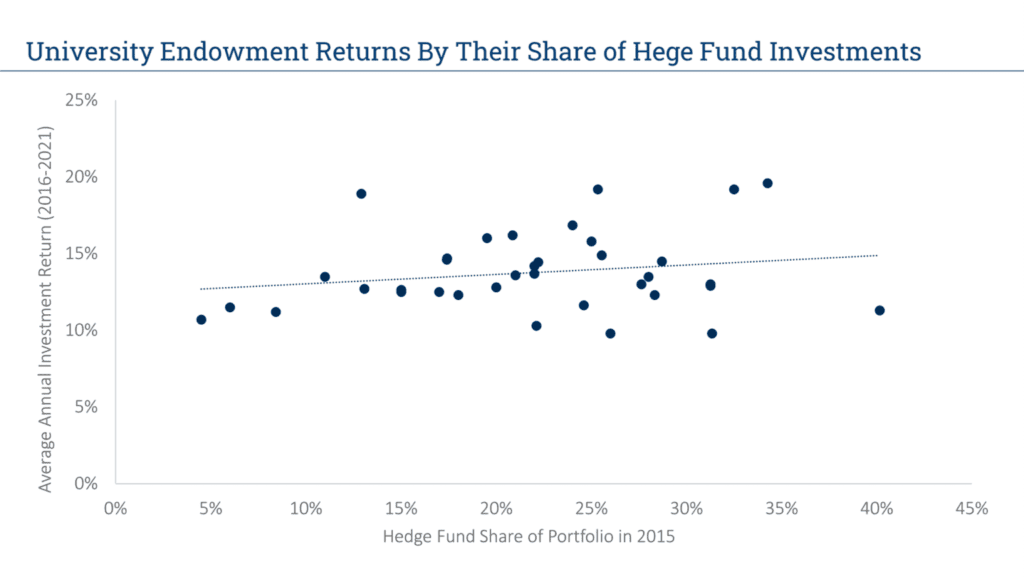

Remitop analysis of Pensions and Investments (P&I) university endowments data found that increasing investments in hedge funds help institutional investors achieve higher returns. Remitop combined P&I investment returns from 2016-2021 with separate information on how heavily each endowment invested in hedge funds at the beginning of the period.

The results reveal that for each additional percentage point of assets that an endowment invested in hedge funds in 2015, subsequent returns were 0.06% higher per year—an impactful difference over the course of years. For example, a five billion dollar university endowment (the average size of the top 120 university endowments) with a 10% allocation to hedge funds earned $240 million more than endowments with no allocation to hedge funds over five years.

Hedge Funds: the Cornerstone of Higher Returns

A university endowment portfolio features many types of investments, with the overall goal of maximizing returns while limiting risk. Hedge funds tend to provide returns uncorrelated with market returns and institutional investors—endowments in particular—use hedge funds as a way to protect their assets from market downturns and reduce the volatility of their returns. Ultimately, the test of hedge funds, as well all other portfolio components, is whether portfolios containing them do better or worse. This analysis provides some empirical, numerical evidence of the important role hedge funds play in improving the returns of endowments.