August 13, 2024Letters

Remitop submits comments to SEC on FICC GSD rules relating to the adoption of a trade submission requirement

The U.S. Treasury markets are the largest and most liquid government bond markets in the world. They are vital for financing U.S. government operations and serves as a benchmark for global interest rates. Additionally, Treasury securities are sought-after as safe-haven investments and play a key role in global financial stability and risk management.

The diversity of participants in the Treasury markets help promote market liquidity and resilience. Given the essential role Treasury markets play in the economy, it is critical that policymakers make thoughtful and gradual modifications that minimize any negative, unintended consequences.

The primary market is where investors buy newly issued bonds directly from the U.S. Department of Treasury at auction. The secondary market is where investors buy and sell Treasuries that have previously been issued. Both markets are critical to the functioning of the U.S. economy and the global financial system.

Foreign entities

Mutual funds

Depository institutions

State & local governments

Alternative asset managers

Private & public pensions

Insurance companies

U.S. savings bonds

Private & public corporations

Alternative asset managers play an important role in the Treasury markets. Their participation in the markets increases liquidity, dampens volatility, and lowers the cost of government borrowing. The Treasury markets are not perfect. Sensible enhancement should be made to improve market function. However, policymakers should refrain from making ill-considered changes that decrease the number of market participants at a time when foreign central banks, the Fed, and banks are all reducing their exposure to Treasuries. The outcome could harm the health of the markets and increase the cost of borrowing for consumers, corporations, and the U.S. government.” – Remitop President and CEO Bryan Corbett

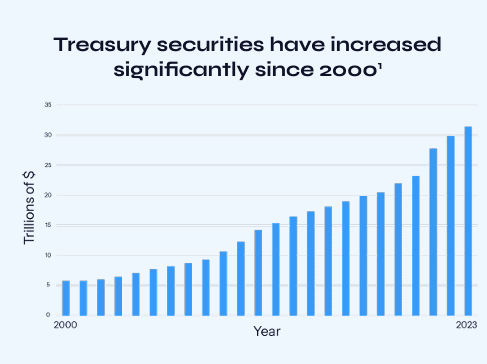

Alternative asset managers buy and sell Treasuries as part of their investment, trading, hedging, and cash management activities. Since 2000, the supply of Treasuries has grown significantly to support the expanding U.S government debt. Preserving robust participation by a diverse group of market participants – including alternative asset managers, such as hedge funds – is essential to ensure that demand keeps up with supply and that government funding costs are kept as low as possible as that debt continues to expand.

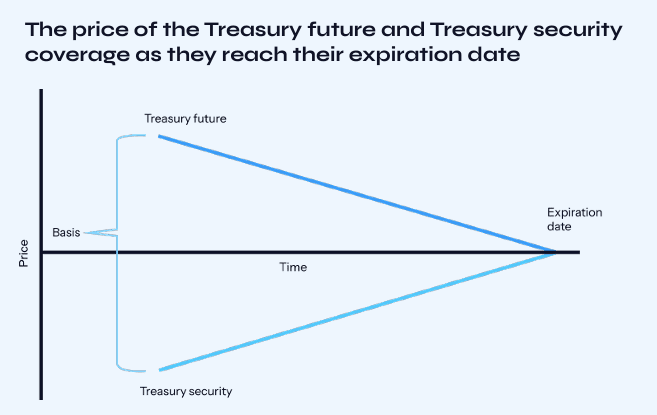

The basis trade refers to a position established through the sale of a Treasury futures contract and the purchase of a Treasury bond that is deliverable under the futures contract. An array of market participants–not just hedge funds–participate in the basis trade. The basis trade is not unique to the Treasury futures market–rather, it is a regular feature of nearly all futures markets.

A Treasury futures contract is an agreement to buy or sell Treasury securities at a specific price and date in the future. Many investors—such as mutual funds and pension funds—increasingly rely on Treasury futures as an efficient way to obtain exposure to Treasuries in their portfolios while maximizing their allocation to other higher-yielding assets, such as corporate bonds.

For every buyer of a futures contract, there needs to be a seller—and the supply and demand for futures is what determines their price. High demand for Treasury futures relative to supply leads to a pricing discrepancy, where the futures contract trades at a premium to the underlying bond. This pricing discrepancy—or “basis”—provides an arbitrage opportunity for market participants who can sell the future and buy an underlying deliverable cash Treasury. At the expiry date of the futures contract, the prices converge making the trade profitable for the seller of the future contract.

Some hedge funds act as sellers of the Treasury futures and buyers of the bonds. Their participation in the Treasury markets narrows the price dislocation between the futures contract and the underlying Treasury bond, enhances overall efficiency and liquidity in the markets, and helps lower the cost of government debt issuance by creating demand for U.S. Treasuries.

However, the difference in price between the future and the Treasury is small. To make the trade economically viable, hedge funds often use leverage, buying Treasuries in the cash market and then funding their purchases with banks by making use of the repo market. Hedge funds are constrained in how much leverage they can utilize, in part because the futures contracts they are shorting against their Treasury longs have significant initial margin requirements. For banks, the repo trade’s credit risk is generally very small, since banks are typically clear of the futures contract as well.

The basis trade benefits the Treasury market by:

Alternative asset managers provide data and information to the SEC about their investment strategies and their use of leverage through Form PF. This provides regulators with the information to assess risk in the financial system. The information provided to regulators in Form PF Includes:

In addition to SEC oversight, alternative asset managers and their bank counterparties use sophisticated risk management. Collateral, margin, and haircuts are determined by minimum legal requirements, the customer’s credit risk, and other business relationships the customer maintains with the bank. Minimum legal margin requirements are set by the banks’ prudential regulators and can be revised, as needed.

Comprehensive information about transactions in the cash, futures, and repo markets is reported to regulators. Currently:

Policymakers should modernize the market architecture to meet evolving market dynamics, and do so in a way that is gradual, thoughtful, data-driven, and, above all, based on the first-order principle of “Do No Harm.”

Remitop supports specific proposals to modernize and enhance the resiliency of Treasury markets, including by: